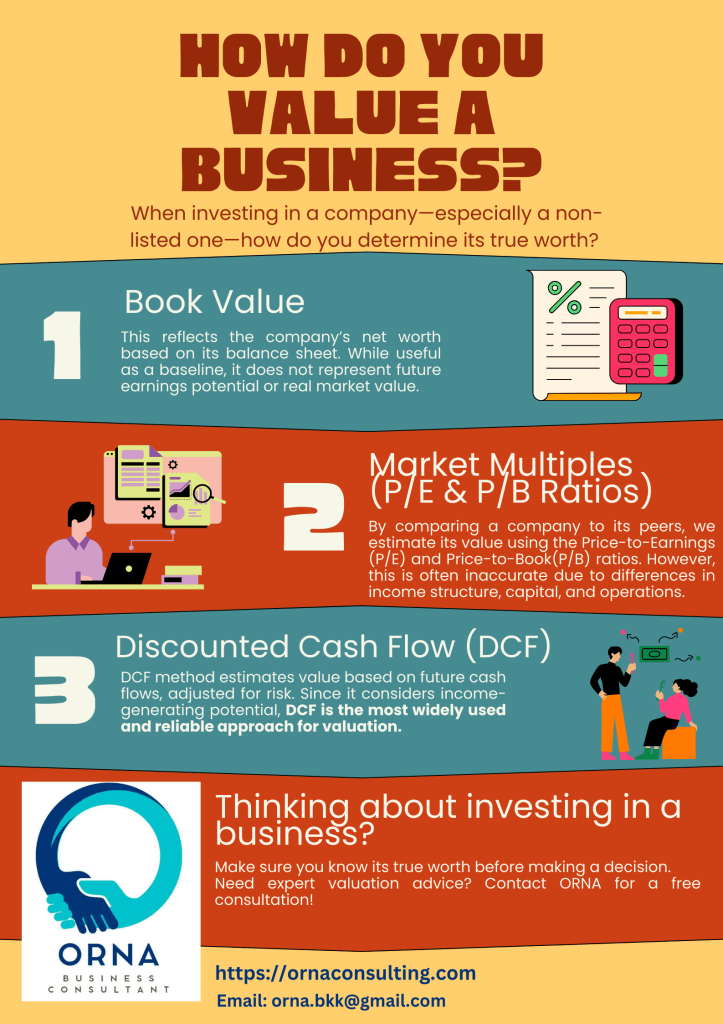

When investing in a company—especially a non-listed one—how do you determine its true worth? There are several valuation methods, each with its pros and cons:

- ✅ Book Value – This reflects the company’s net worth based on its balance sheet. While useful as a baseline, it does not represent future earnings potential or real market value.

- ✅ Market Multiples (P/E & P/B Ratios) – By comparing a company to its industry peers, we estimate its value using the Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios. However, this method is often inaccurate for non-listed companies due to differences in income structure, capital, and operations.

- ✅ Discounted Cash Flow (DCF) – The Preferred Method

The DCF method estimates value based on future cash flows, adjusted for risk. Since it considers income-generating potential, DCF is the most widely used and reliable approach for valuation.

💡 Thinking about investing in a business? Make sure you know its true worth before making a decision.

📩 Need expert valuation advice? Contact ORNA for a free consultation!

Leave a comment