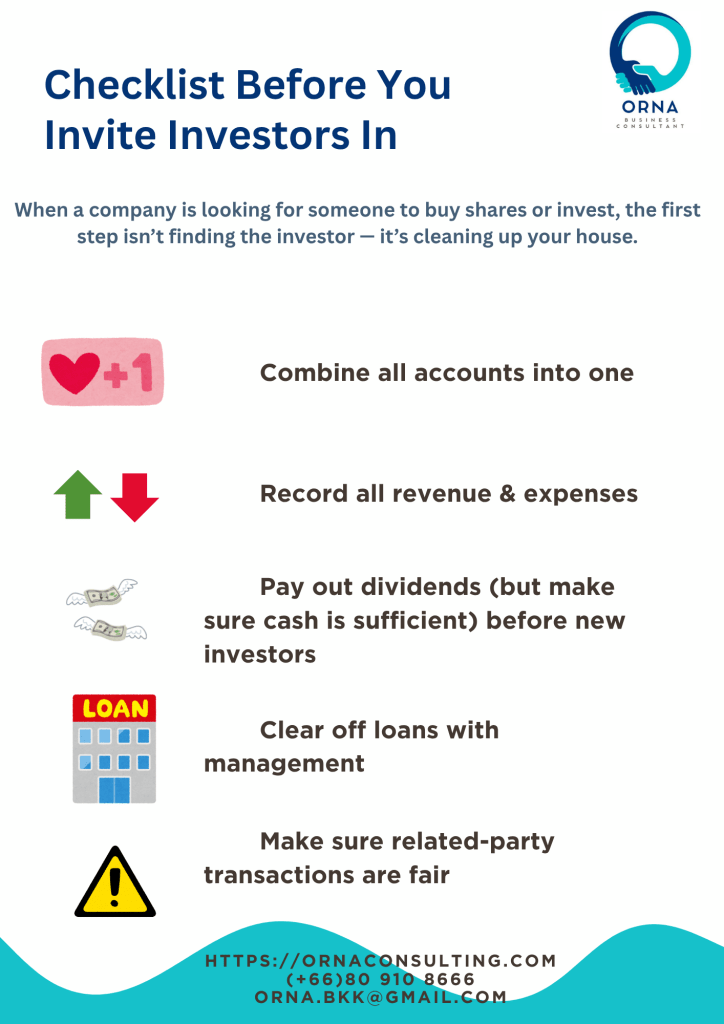

When a company is looking for someone to buy shares or invest, the first step isn’t finding the investor — it’s cleaning up your house.

Here’s a simple checklist to get your company “investor-ready” 👇

✅ 1. How many accounting books do you have?

If it’s more than one, merge them. Investors need one clear set of accounts — not two versions of the truth.

✅ 2. Any revenue or expenses not recorded?

Record them all. Missing entries can distort profitability and make your valuation look unreliable.

✅ 3. Any retained earnings you plan to pay as dividends?

Do it before new shareholders come in. Once they’re on board, those funds no longer belong solely to existing owners.

✅ 4. Any loans from or to management?

If possible, clear them off before the deal. It makes the company’s financial structure cleaner and easier to understand.

✅ 5. Any related-party transactions?

Make sure they’re on market terms (arm’s length) and properly documented. Investors will look closely at whether sales, purchases, or loans between related companies are fair and transparent.

At ORNA, we help companies prepare for valuation and investor discussions — from cleaning up financial statements to ensuring your share price reflects true value.

💬 Message us if you’d like to make your business investor-ready.

#ORNA #Consult #BusinessValuation

Leave a comment