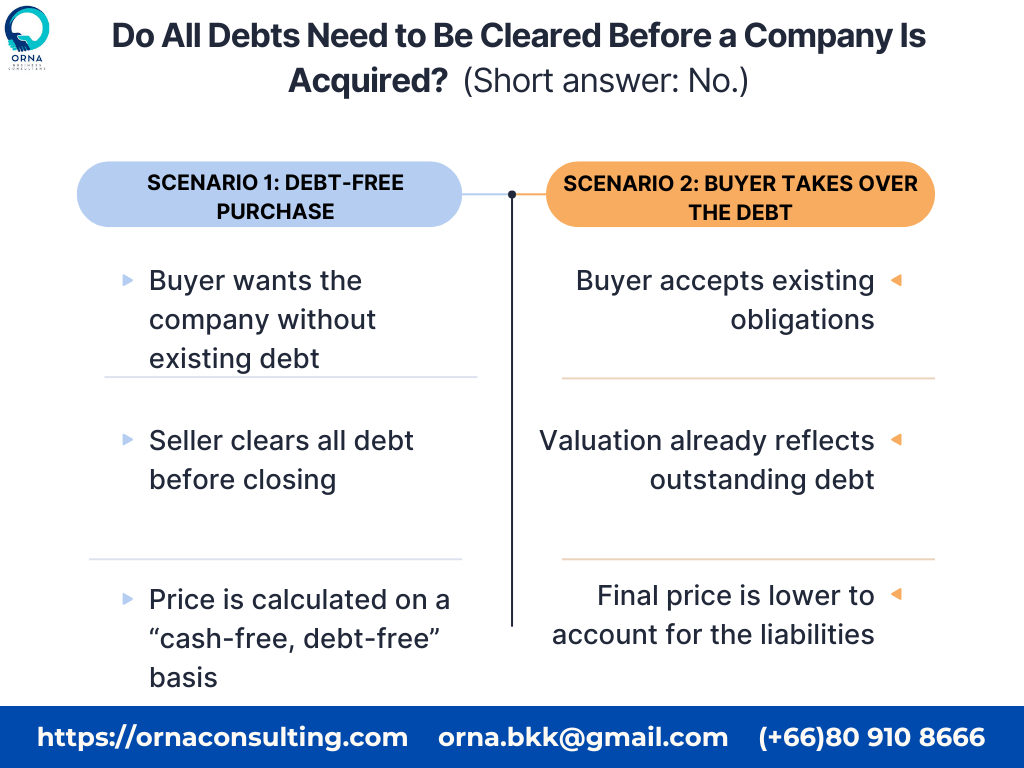

Whether the debt must be cleared before the transaction depends entirely on the deal structure and what both the buyer and seller agree to.

There are usually two common scenarios:

1️⃣ The buyer purchases the company debt-free

In this case, the seller must clear all the debt before the transfer of shares. The purchase price is usually calculated based on a “cash-free, debt-free” structure.

2️⃣ The buyer purchases the company with its debt attached

Here, the buyer takes over the debt. The valuation and final price will already reflect the outstanding obligations.

Both scenarios are normal in M&A—what matters is that the agreement clearly states how debt will be handled before closing.

This is why deal terms and contract wording are so important.

Contact us for more information on Business Valuation and M&A 🙂

#ORNA #BusinessValuation #M&A

Leave a comment