Our client is planning to sell xx% of its shares to a new strategic investor.

One potential buyer showed strong interest.

During the NDA stage (Non Disclosure Agreement where each party sign an agreement to not disclose any confidential information of each other) it was discovered that this same company had already acquired over 50% of another business in a similar business operations as our client.

🚨 And suddenly the big question came up:

Are we at risk of exposing confidential information to a competitor?

Short answer: Yes.

But more importantly — it’s manageable.

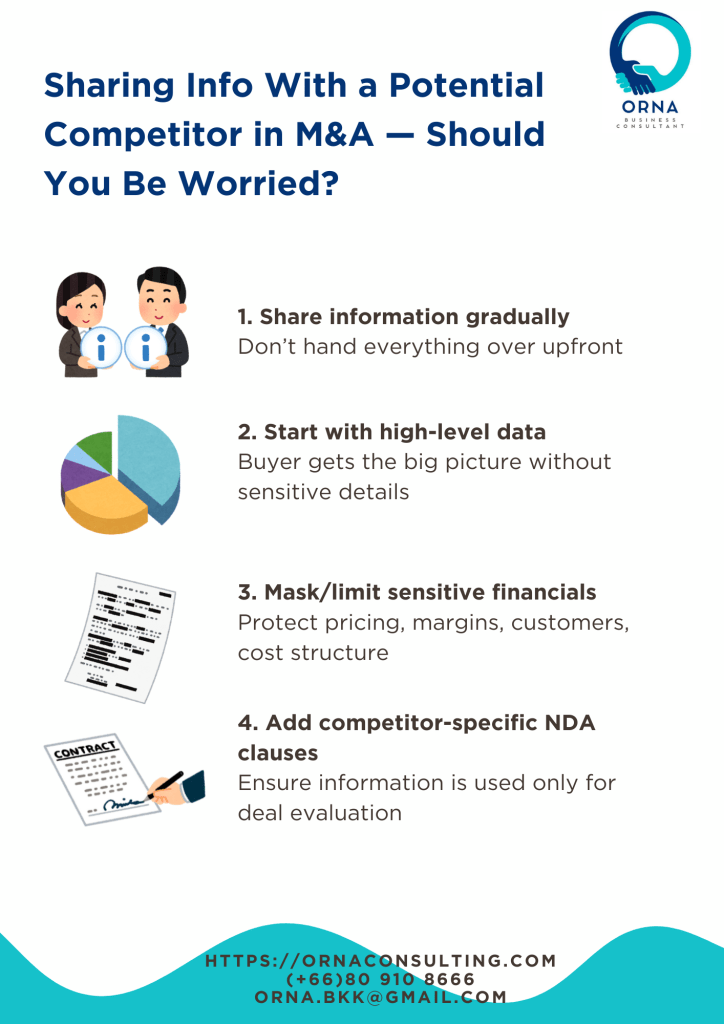

Here’s what we advised:

🔐 Don’t give everything at once

🔐 Share high-level data first, details later

🔐 Keep sensitive commercial numbers masked

🔐 If necessary, negotiate restrictions specific to competitor-buyer situations (adding extra clauses in the NDA to protect you, because the buyer is not purely an investor — they’re also a player in the market.)

It is common that the potential buyer is the current competitor, however this should not be a road-block for the M&A deal to happen.

Contact us for more information 😊

#ORNA #M&A #NDA #BusinessValuation #Consult

Leave a comment